Federal Reserve Monetary Policy

Over its more than 100-year history, the Federal Reserve has made significant innovations in the understanding and use of monetary policy. This timeline covers significant events in the development of the Fed's monetary policy tools, policies, and communication. The multicolored bars in the top row of the display provide context by showing recessions and other periods significant to U.S. economic history. The green dots in the second row show important events in the development of Federal Reserve monetary policy.

LEGEND

Bars: Recessions and significant economic periods

Dots: Monetary policy events

-

December 23, 1913 | Policy Toolbox: Federal Reserve Act

Woodrow Wilson signs the Federal Reserve Act into law on December 23, creating the Federal Reserve System during the recession of 1913-1914. The Act does not directly mention monetary policy, but it does direct the Fed to "furnish an elastic currency, to afford means of rediscounting commercial paper." To perform that role, Federal Reserve Banks are given a lending facility—their discount windows—through which member commercial banks can rediscount eligible financial assets in exchange for currency or deposit balances with the Fed. The Federal Reserve Act explicitly prohibits the rediscount of "notes, drafts, or bills covering merely investments or issued or drawn for the purpose of carrying or trading stocks, bonds, or other investment securities, except bonds and notes of the Government of the United States."

Save & Share

Save & Share -

1914-1919 | World War I

The outbreak of World War I just before the opening of the Federal Reserve affects the international gold market and the policies of European central banks. By setting a low discount rate on loans secured by Treasury securities, the Federal Reserve encourages banks to purchase U.S. government securities. The Fed's open market purchases increase System holdings of Treasury securities from $66 million in June 1917 to $236 million in June 1919.

Save & Share -

November 16, 1914 | Federal Reserve Banks open

In the early years of the Federal Reserve System, the twelve Reserve Banks are relatively autonomous and set their own policies and discount rates with approval from the Board. Many early Fed leaders and other prominent bankers are proponents of the "real bills doctrine," which asserts that Fed lending will not cause inflation if restricted to rediscounting of short-term "paper" or "bills" in the form of commercial and agricultural loans.

Save & Share

Save & Share -

December 31, 1914 | First Open Market Purchases

The New York Fed, under the leadership of Benjamin Strong Jr., makes the System's first open market purchase ($5 million in New York City tax anticipation bonds) less than 2 months after the Banks open. Early open market purchases are conducted primarily to bolster Reserve Bank earnings. At the first conference of the twelve Reserve Bank governors (now called presidents), New York becomes the de facto coordinator of open market operations.

Save & Share -

September 7, 1916 | Policy Toolbox: Member Borrowing

The Federal Reserve Act is amended in 1916 to permit member banks to borrow directly from the Fed with eligible collateral. These new loans are called "advances"—a change from the earlier form of Fed lending, known as "discounts." With a discount, the member bank endorsed and then borrowed against a specific commercial or agricultural loan. When the loan matured, the proceeds were used to repay the Fed. If the original borrower defaulted, the member bank was still required to pay the loan's value to the Fed.

Save & Share -

August 1918-March 1919 (7 months) | Recession

Save & Share -

January 1920-July 1921 (18 months) | Recession

Save & Share -

1922 | Coordinated Open Market Operations

Beginning in 1922, the Fed Governors Conference sets up a "Committee on the Centralized Execution of Purchases and Sales of Government Securities" to recommend specific open market purchases and rates and to execute orders of the twelve Banks. Benjamin Strong of the New York Fed chairs the new committee.

Save & Share -

April 1923 | Policy Toolbox: The OMIC

The Board moves to replace the Governors' committee with the Open Market Investment Committee (OMIC) to centralize open market operations under the general supervision of the Board and away from individual Reserve Banks. It is also intended to better coordinate Federal Reserve and Treasury policies. The new OMIC, consisting of five Reserve Bank governors, coordinates open market purchases across the Federal Reserve Banks, but individual Banks still conduct some independent open market operations.

Save & Share -

May 1923-July 1924 (14 months) | Recession

Save & Share -

October 1926-November 1927 (13 months) | Recession

Save & Share -

August 1929-August 1945 | The Great Depression

The period known as the Great Depression begins with a severe recession in late 1929. That recession lasts until 1933. The Fed's policy actions in response to the recession, including allowing the collapse of the banking system, have significant repercussions. As the economy recovers, another significant recession occurs in 1937-38. Decades later, in a 2002 speech, Fed Chairman Ben Bernanke acknowledges the views of scholars such as Milton Friedman regarding the Fed's policy errors: "Regarding the Great Depression. You're right, we did it. We're very sorry. But thanks to you, we won't do it again."

Save & Share -

January 1930 | Open Market Policy Conference

The Open Market Policy Conference (OMPC), which includes all twelve Reserve Bank governors, is established to further consolidate and coordinate open market operations under the authority of the Board.

Save & Share -

July 21, 1932 | Policy Toolbox: Section 13(3)

With the Emergency Relief and Construction Act, Congress expands the Fed's lending authority beyond banks by adding Section 13(3) to the Federal Reserve Act, which permits the Board of Governors in "unusual and exigent circumstances" to authorize Reserve Banks to extend credit to individuals, partnerships, and corporations.

Save & Share -

June 16, 1933 | Glass-Steagall Establishes FOMC

The Banking Act of 1933 (better known as Glass-Steagall) eliminates the OMPC and establishes the Federal Open Market Committee (FOMC). Unlike prior open market policy committees, the decision of the FOMC is binding on the Reserve Banks.

Save & Share

Save & Share -

February 8, 1935 | Transparency: Press Conference

Chairman Marriner Eccles gives what may be the first Federal Reserve press conference, discussing upcoming changes to Fed structure and open market operations

Save & Share -

August 23, 1935 | Banking Act of 1935

The Banking Act of 1935 creates the FOMC's modern structure, including the rotation of Reserve Bank presidents. Control of open market operations is officially vested in the FOMC. These operations are implemented through the trading facilities at the Federal Reserve Bank of New York. The Act also consolidates control of the other tools of monetary policy in the Board of Governors. (These tools include setting reserve requirements and authority over the discount rate in each Federal Reserve District.)

Save & Share -

March 18, 1936 | First Meeting of the Modern FOMC

The Federal Open Market Committee changes set forth in the Banking Act of 1935 take effect. Marriner Eccles, who had been Governor of the Federal Reserve Board since November 14, 1934, becomes the first Chairman of the new FOMC. (He had become Chairman of the new Board of Governors in February 1936.)

Save & Share -

1936-1937 | Policy Toolbox: Reserve Requirements

An inflow of gold in the mid-1930s increases the "excess reserves" of member banks, which increases the risk of inflationary credit expansion. To reduce excess reserves, the Board uses its new power granted by the Banking Act of 1935 to increase reserve requirements in three steps during 1936-37 (turning excess into required reserves). The Treasury begins to sterilize gold inflows.

Save & Share -

August 1941 | Policy Toolbox: Regulation W

Following the Executive Order of August 9, the Federal Reserve establishes Regulation W to regulate consumer credit for purchases of durable goods. Between 1941 and 1952, the Fed regulates and restricts consumer credit for products including automobiles, appliances, TVs, vacuums, furniture, and even jewelry. Between 1950 and 1952, the Fed also regulates mortgage lending under Regulation X. Both programs are intended to combat inflation without causing interest rates on Treasury securities to rise.

Save & Share -

1942-1951 | Wartime economic policy

As the United States enters World War II, the Treasury and the Federal Reserve agree to control nominal interest rates on government securities. The Treasury would continue to dominate Federal Reserve policy through the beginning of the Korean War in 1950, until the Treasury-Fed Accord of 1951.

Save & Share -

July 7, 1942 | Transparency: FOMC Membership

Congress amends the Federal Reserve Act to prescribe the specifics of the rotating membership of the FOMC. This act also gives the Federal Reserve Bank of New York a permanent seat on the FOMC.

Save & Share -

February 1945-October 1945 (8 months) | Recession

Save & Share -

February 20, 1946 | Employment Act of 1946

The Employment Act makes a "declaration of policy" that it is the responsibility of the federal government to "promote maximum employment, production and purchasing power." The bill acknowledges the importance of maintaining purchasing power—that is, the need to keep inflation in check.

Save & Share -

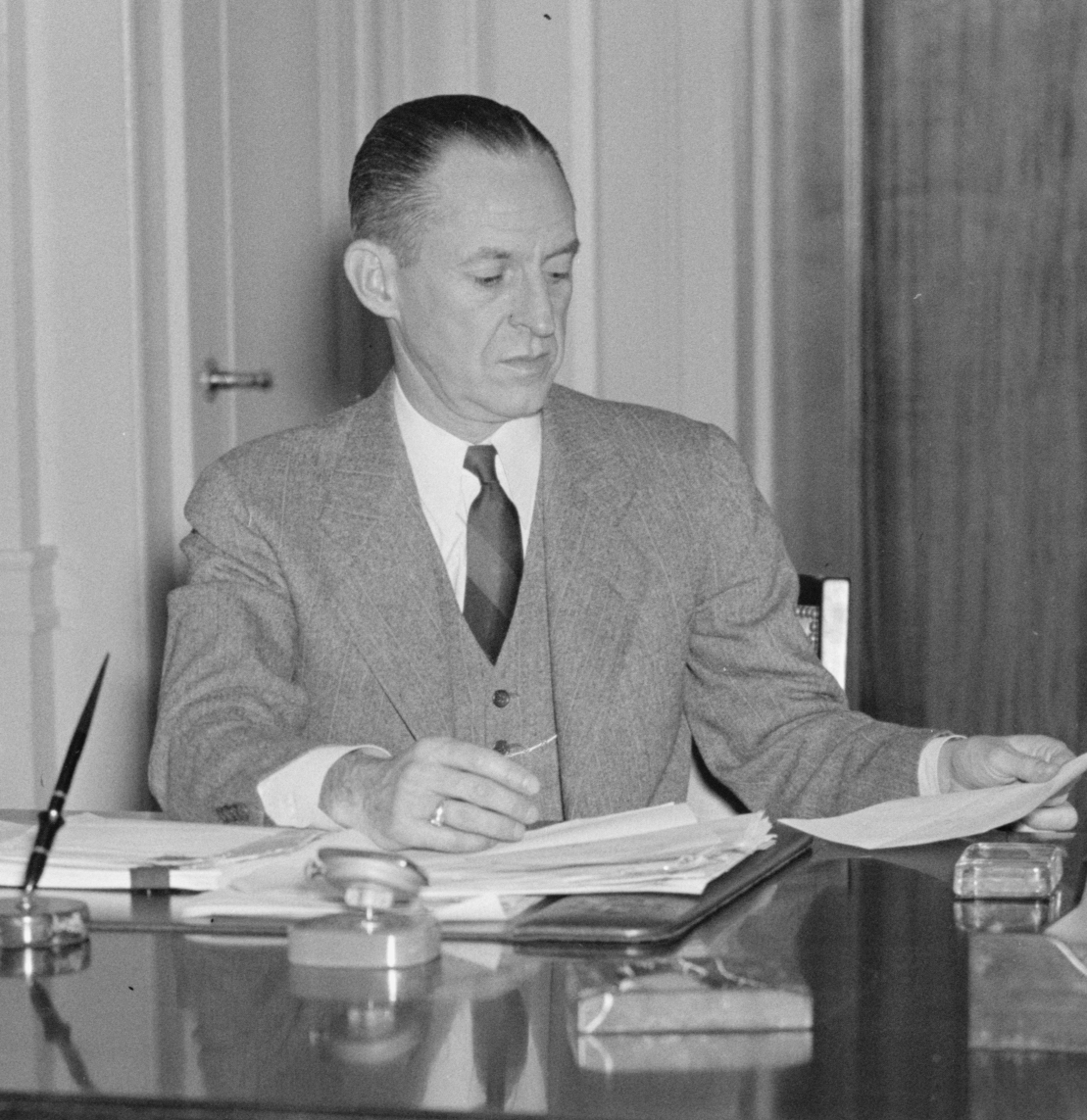

April 15, 1948 | McCabe Becomes Chairman

Thomas B. McCabe is sworn in as Chairman of the Board of Governors of the Federal Reserve System. (President Truman declines to renominate Marriner Eccles to the position, but Eccles remains on the Board as a Governor for another two and a half years.)

Save & Share

Save & Share -

November 1948-October 1949 (11 months) | Recession

Save & Share -

January 25, 1951 | Tension with Treasury Builds

During testimony to congress, Chairman Eccles breaks with the "real bills" tradition when he states that it is the unrestrained creation of bank reserves in defense of the rate peg that made the Federal Reserve into "an engine of inflation."

Save & Share -

March 4, 1951 | Policy Toolbox: Treasury-Fed Accord

The Treasury and the Fed issue a statement that they have "reached full accord with respect to debt management and monetary policies to be pursued in furthering their common purpose and to assure the successful financing of the government's requirements and, at the same time, to minimize monetization of the public debt." The new accord freed the Fed to pursue an independent monetary policy.

Save & Share -

April 2, 1951 | Martin Becomes Chairman

William McChesney Martin Jr. is sworn in as Chairman of the Board of Governors of the Federal Reserve System.

Save & Share

Save & Share -

1953 | Lean-against-the-wind

The FOMC under Chairman Martin begins to lower interest rates in response to recession. This began what would later be known as the era of "lean against the wind"—that is, of monetary policy dedicated to the stabilization of economic activity. This policy stance would last throughout the 1950s and 1960s.

Save & Share -

July 1953-May 1954 (10 months) | Recession

Save & Share -

October 19, 1955 | The punch bowl speech

Chairman Martin gives his famous "punch bowl" speech, stating that the Federal Reserve is in the position of a "chaperone who has ordered the punch bowl removed just when the party was really warming up." This famous metaphor illustrated the Fed's philosophy of slowing inflation in expansionary times and stimulating the economy during downturns, in an attempt to avoid catastrophic crashes and recessions.

Save & Share -

August 1957-April 1958 (8 months) | Recession

Save & Share -

1958 | Launch of the Bretton Woods System

With the elimination of exchange controls for current-account transactions, the Bretton Woods system launches as an international system in which other countries' currencies are pegged to the dollar and the dollar is set to $35 per ounce of gold. The Fed's responsibility under this system is to set monetary policy to maintain the fixed exchange rate.

Save & Share -

November 1958 | The "Phillips Curve" Published

In the journal Economica, William Phillips documents a negative relationship between wage inflation and unemployment in the United Kingdom. By the mid-1960s, economists Paul Samuelson and Robert Solow note a similar relationship in the United States between price inflation and unemployment. The Phillips curve captures a tradeoff that policymakers of the time began to consider when setting policy: They could pursue lower unemployment if they were willing to accept higher inflation. Conversely, if they wanted to pursue lower inflation, they would have to accept higher unemployment and less economic activity. Many scholars believe the Phillips Curve influenced monetary policymakers for decades.

Save & Share -

April 1960-February 1961 (10 months) | Recession

Save & Share -

Early 1961 | Operation Twist

In an attempt to both lessen the balance-of-payments deficit and end the recession, the Fed purchases long-term Treasury bonds while simultaneously selling short-term bills. The move is intended to flatten or "twist" the normal upward-sloping yield curve. Operation Twist marks the end of the 1953 "bills only" policy stance.

Save & Share -

May 17, 1961 | Transparency: St. Louis Fed Releases Monetary Data

St. Louis Fed research director Homer Jones sends three monetary data tables to interested monetary economists. This is the earliest known documentation of the St. Louis Fed's data dissemination initiatives, which would eventually lead to the development of FRED® and other economic information websites.

Save & Share -

1965-1982 | Great Inflation

Between 1965 and 1982, the U.S. economy experiences four recessions and two major energy shocks and sees inflation balloon from around 1% to over 14%. Economists widely agree that Fed policy contributed to the high inflation, but they disagree about the underlying reasons. Some suggest that the Fed succumbed to political pressure, or failed to account for the distinction between nominal and real interest rates, while others argue that the Fed mistook trends in potential output and took overly stimulative policy actions.

Save & Share -

January 31, 1970 | Burns Becomes Chairman

Arthur Burns is sworn in as Chairman of the Board of Governors of the Federal Reserve System.

Save & Share

Save & Share -

April 1971 | Transparency: M1, M2, and M3 Debut

The three measures of the money stock are first published by the Board in April 1971. The existing money stock measure becomes "M1"; "M2" adds savings deposits and certificates of deposit; and "M3" adds deposits at mutual savings banks and savings and loans. (M3 is discontinued in 2006.)

Save & Share -

November 16, 1977 | Federal Reserve Reform Act

The new Federal Reserve Reform Act explicitly directs the Fed to "promote the goals of maximum employment, stable prices, and moderate long-term interest rates" and requires the Board of Governors to report at semiannual hearings before both the House and Senate about the FOMC's objectives, performance, and plans for the growth of money and credit.

Save & Share -

March 8, 1978 | Miller Becomes Chairman

G. William Miller is sworn in as Chairman of the Board of Governors of the Federal Reserve System.

Save & Share

Save & Share -

November 27, 1978 | Transparency: Humphrey-Hawkins

The Full Employment and Balanced Growth Act of 1978 (often called the Humphrey-Hawkins Act, after its two congressional sponsors) establishes new reporting mandates for Fed monetary policy. Specifically, it requires the Board of Governors to submit a written report twice a year and requires the Chair to testify to both the Senate and House committees that oversee banking. (The Fed continues to follow its reporting requirements even after the act's expiration in 2000.)

Save & Share -

August 6, 1979 | Volcker Becomes Chairman

Paul Volcker is sworn in as Chairman of the Board of Governors of the Federal Reserve System.

Save & Share

Save & Share -

October 6, 1979 | Saturday Night Special

On the night of Saturday, October 6, the Fed announces it will raise the rate of interest it charges on loans to member banks by a full percentage point. Chairman Volcker states the FOMC is prepared to allow interest rates to fluctuate more widely than at any time in recent history in order to focus on controlling the growth of bank reserves and the money supply. By June 1981, the federal funds rate would reach a peak of 20%.

Save & Share -

March 31, 1980 | Monetary Control Act

Among its other changes to the banking industry, the Depository Institutions Deregulation and Monetary Control Act of 1980 requires all depository institutions to meet reserve requirements. This change strengthens the Fed's ability to control the money supply.

Save & Share -

June 1983 | Transparency: Beige Book Debuts

The "Summary of Commentary on Current Economic Conditions by Federal Reserve District," known as the "Beige Book" for the color of its original cover, is first released to the public. The Beige Book, which is prepared by staff at the twelve Reserve Banks, provides qualitative insights on the regional economies of the Districts.

Save & Share -

August 11, 1987 | Greenspan becomes Chairman

Alan Greenspan is sworn in as Chairman of the Board of Governors of the Federal Reserve System.

Save & Share

Save & Share -

July 1990-March 1991 (8 months) | Recession

Save & Share -

March 26, 1993 | Transparency: First FOMC Minutes Published

To provide more information about its actions, the FOMC publishes its minutes for the first time (they were the minutes of the February 2-3 meeting).

Save & Share -

December 1993 | The "Taylor rule" Published

John Taylor publishes his paper setting forth the "Taylor rule," a numerical formula that relates the FOMC's target for the federal funds rate to the current state of the economy. The paper starts a larger discussion about whether monetary policy should be set by rules or by the discretion of FOMC policymakers.

Save & Share -

February 1994 | Transparency: First FOMC Post-meeting Policy Statement

In a move to provide more information about its policy decisions, the FOMC announces the outcome of a meeting in a policy statement for the first time. A year later at the February 1995 FOMC meeting, policy statements become part of the communication process for all monetary policy changes.

Save & Share -

February 1994 | Transparency: Transcripts of FOMC Meetings Released

Beginning with the 1994 meetings, the FOMC Secretariat produces transcripts shortly after each meeting from an audio recording of the proceedings. These are released five years after the meeting.

Save & Share -

July 2-3, 1996 | Transparency: Defining "Price Stability"

Chairman Greenspan defines the price stability goal of monetary policy as "that state in which expected changes in the general price level do not effectively alter business or household decisions." This articulation provides clarity about the Fed's understanding of its price stability objective.

Save & Share -

December 5, 1996 | "Irrational Exuberance"

Save & Share -

January 2000 | Transparency: FOMC Policy Statement Released after Every Scheduled Meeting

The FOMC announces that it would issue a policy statement following each regularly scheduled meeting, regardless of whether there had been a change in monetary policy.

Save & Share -

March 2001-November 2001 (8 months) | Recession

Save & Share -

September 11, 2001 | Response to the September 11 Attacks

In response to the terrorist attacks of September 11, the Board of Governors issues a simple statement that "The Federal Reserve System is open and operating. The discount window is available to meet liquidity needs." The FOMC follows up by lowering the federal funds rate target by 50 basis points, to 3 percent. It also states that it will continue to "supply unusually large volumes of liquidity to the financial markets, as needed, until more normal market functioning is restored."

Save & Share -

December 2004 | Transparency: FOMC Expedites Release of Meeting Minutes

To increase policy transparency, the FOMC expedites the release of its meeting minutes, making them available three weeks after each meeting.

Save & Share -

February 1, 2006 | Bernanke Becomes Chairman

Ben S. Bernanke is sworn in as Chairman of the Board of Governors of the Federal Reserve System.

Save & Share

Save & Share -

October 30, 2007 | Transparency: FOMC Publishes Summary of Economic Projections

Beginning with the October 30-31, 2007, meeting, FOMC meeting participants submit individual economic projections in conjunction with four FOMC meetings a year. A compilation and summary of these projections is circulated to participants, and a detailed summary of the economic projections (the Summary of Economic Projections, or "SEP") is included as an addendum to the minutes that are released three weeks after the meeting.

Save & Share -

December 2007-June 2009 (18 months) | Great Recession

The "Great Recession" begins in December 2007 and ends in June 2009. The Federal Reserve's response to the recession and financial crisis evolves over time. Initially, the Fed employs traditional policy actions by reducing the federal funds rate from 5.25 percent in September 2007 to a range of 0-0.25 percent in December 2008. Then, with the federal funds rate at its effective lower bound, the FOMC begins to use its policy statement to provide forward guidance for the federal funds rate. In addition, the Fed pursues two other types of nontraditional policy actions. One set of nontraditional policies is characterized as credit easing programs that seeks to facilitate credit flows and reduce the cost of credit. Another set of nontraditional policies consists of the large-scale asset purchase (LSAP) programs. With the federal funds rate near zero, the asset purchases are implemented to push down longer-term public and private borrowing rates.

Save & Share -

December 12, 2007 | Fed Creates TAF

To ease credit conditions during the Great Recession, the Federal Reserve announces creation of a Term Auction Facility (TAF) in which fixed amounts of term funds will be auctioned to depository institutions.

Save & Share -

2008-2014 | Large-scale Asset Purchases

Between 2008 and 2014, to ease the stance of monetary policy, the FOMC authorizes three rounds of large-scale asset purchases (also known as "quantitative easing") as well as the Maturity-Extension Program (known publicly as "Operation Twist") which was designed to extend the average maturity of Treasury securities in the Federal Reserve's portfolio. These unconventional tools are used on different occasions to support the flow of credit to households and businesses and promote the stability of the financial system itself, especially when the FOMC's target for the federal funds rate (the Fed's policy rate) is at the effective lower bound (0 to 25 basis points).

Save & Share -

October 6, 2008 | Policy Toolbox: Interest on Required and Excess Reserves

The Federal Reserve Board announces that the Fed will pay interest on depository institutions' required and excess reserve balances. Paying interest on reserves later develops into the Fed's primary tool for steering the federal funds rate into the target range set by the FOMC.

Save & Share -

December 16, 2008 | Setting the Zero Lower Bound

The FOMC votes to establish a target range for the effective federal funds rate of 0 to 0.25 percent. This is the first time the lower end of the range was set to zero (sometimes known as the "zero lower bound"); the rate stays at this unprecedented low rate until December 16, 2015.

Save & Share -

July 21, 2010 | Dodd-Frank Changes Emergency Lending

The Dodd-Frank Wall Street Reform and Consumer Protection Act provides wide-ranging prescriptions aimed at correcting the causes of the 2007-09 financial crisis. Through Dodd-Frank the Federal Reserve lost some autonomy to extend emergency credit to non-bank institutions. Specifically, Dodd-Frank requires explicit approval by the U.S. Secretary of the Treasury to set up any such programs and limits non-bank lending to programs that are broadly available to many firms rather than lending to a single borrower.

Save & Share -

March 24, 2011 | Transparency: Regular Press Briefings

To increase policy transparency, Chairman Bernanke announces he will hold four press briefings per year to present the FOMC's current economic projections and provide additional context for policy decisions.

Save & Share -

April 26-27, 2011 | Transparency: Summary of Economic Projections

To increase policy transparency, an advanced version of the Summary of Economic Projections table on the ranges and central tendencies of the participants' projections is released in conjunction with the Chairman's post-meeting press conference.

Save & Share -

January 24, 2012 | Transparency: FOMC Sets 2% Inflation Goal

To provide further clarity of the FOMC's understanding of its goals, Chairman Bernanke formally and publicly announces the FOMC will target a 2 percent inflation rate, as measured by the index for personal consumption expenditures (PCE), in pursuit of its price stability goal.

Save & Share -

January 25, 2012 | Transparency: Longer-run Goals and Strategy

To provide transparency of its policy goals and implementation, the FOMC releases the Statement on Longer-Run Goals and Monetary Policy Strategy, which articulates the framework for monetary policy and serves as the foundation for the FOMC's policy actions. The FOMC intends to reaffirm these principles and to make adjustments as appropriate at its annual organizational meeting each January.

Save & Share -

June 19, 2013 | The "Taper Tantrum"

In an episode known as the "Taper Tantrum," Chair Bernanke optimistically describes economic conditions and suggests that asset purchases might be reduced later in 2013: "[T]he Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year." The statement leads to a strong market reaction as investors sell bonds, resulting in falling bond prices and higher yields.

Save & Share -

February 3, 2014 | Yellen Becomes Chair

Janet L. Yellen is sworn in as Chair of the Board of Governors of the Federal Reserve System. She is the first woman to hold the position.

Save & Share

Save & Share -

September 14, 2014 | Policy Toolbox: Establishment of the Overnight Reverse Repurchase Agreement Facility

The Policy Normalization Principles and Plans states that the FOMC intends to use an overnight reverse repurchase agreement (ON RRP) facility as a supplementary policy tool to help control the federal funds rate.

Save & Share -

December 16, 2015 | Policy Toolbox: Liftoff

The FOMC lifts the target range for the federal funds rate above the zero lower bound for the first time since December 16, 2008, using new monetary tools such as interest on reserve balances and the overnight reverse repurchase agreement facility.

Save & Share -

February 5, 2018 | Powell Becomes Chair

Jerome H. Powell is sworn in as Chair of the Board of Governors of the Federal Reserve System.

Save & Share

Save & Share -

June 13, 2018 | Transparency: Press Conferences after Every FOMC Meeting

To increase policy transparency, Chair Powell announces that beginning in January 2019, he will hold a press conference after each scheduled FOMC meeting. The intent is to "explain our actions and answer your questions."

Save & Share -

January 30, 2019 | Policy Toolbox: Ample Reserves Implementation Regime

The FOMC formalizes its use of several new tools to "implement monetary policy in a regime in which an ample supply of reserves ensures that control over the level of the federal funds rate and other short-term interest rates is exercised primarily through the setting of the Federal Reserve's administered rates" and notes "the supply of reserves is not required."

Save & Share -

February-April 2020 | Recession

Save & Share -

Early 2020 | COVID-19 Pandemic Reaches U.S.

On March 3, 2020, the FOMC holds an unscheduled meeting about COVID-19's evolving risks to economic activity and lowers the policy rate target range ½ percentage point to 1 to 1¼ percent. The FOMC says it will monitor developments and use its tools to support the economy.

Save & Share -

March 15, 2020 | Policy Toolbox: Response to COVID-19 Pandemic

To support the economy and financial markets during the COVID-19 pandemic, the FOMC takes decisive action, providing support in three ways: (1) To reduce borrowing costs for households and businesses, the FOMC lowers the federal funds rate to 0 to 25 basis points; (2) the Fed buys U.S. Treasury securities and mortgage-backed securities to stabilize financial markets; (3) the Fed uses the authority granted in Section 13(3) of the Federal Reserve Act to support the flow of credit to businesses, households, and communities by introducing several temporary lending and funding facilities. For example, the Paycheck Protection Liquidity Facility supported the related Paycheck Protection Program created by the CARES Act and administered by the Small Business Association.

Save & Share -

March 26, 2020 | Policy Toolbox: FOMC Lowers Reserve Requirements to Zero

Reserve requirement ratios are set to zero, meaning that banks do not have any required reserves. This change effectively ends the use of reserve requirements as a policy implementation tool.

Save & Share -

August 27, 2020 | Transparency: FOMC Updates Longer-run Goals and Monetary Policy Strategy

The FOMC updates its longer-run goals and monetary policy strategy to read that it "seeks to achieve inflation that averages 2 percent over time" and that it will be informed by its "assessments of the shortfalls of employment from its maximum level." The new language is referred to as a flexible average inflation targeting (FAIT) policy and communicates the FOMC's understanding that its inflation goal is symmetric around 2 percent.

Save & Share -

March 12, 2021 | Policy Toolbox: FOMC Formally Sets Reserve Requirements to Zero

The Board of Governors adopts a final rule, without change, to lower reserve requirement ratios to 0 percent. While reserve requirements have been largely irrelevant as a monetary policy tool for many years, the ruling effectively ends reserve requirements as an active monetary policy tool.

Save & Share -

July 2021 | Policy Toolbox: FOMC Establishes Two Standing Repo Facilities

The two standing repo facilities (one for domestic and another for foreign or international authorities) will serve as backstops in money markets to support the effective implementation of monetary policy and smooth market functioning. This provides the Fed with another implementation tool.

Save & Share

Further Reading on Monetary Policy and its History

- Board of Governors: Overview notes on monetary policy principles and practice

- Board of Governors: The Fed Explained

- Federal Reserve History: Monetary Policy

- FRASER: Federal Open Market Committee theme

- David Earl Lindsey, "A Modern History of FOMC Communication: 1975-2002"

- Allan Meltzer, A History of the Federal Reserve (3 volumes)

- San Francisco Fed: Teacher Resources: "What is the Fed: Monetary Policy"

- St. Louis Fed: Teaching the New Tools of Monetary Policy

- St. Louis Fed: Independence, Accountability, and the Federal Reserve System

- St. Louis Fed: In Plain English - Making Sense of the Federal Reserve

Federal Reserve Monetary Policy. https://fraser.stlouisfed.org/timeline/monetary-policy-history, accessed on December 11, 2025.